As an independent firm dedicated exclusively to managing assets for wealthy individuals, families, and foundations, the firm adheres to a rigorous investment selection process.

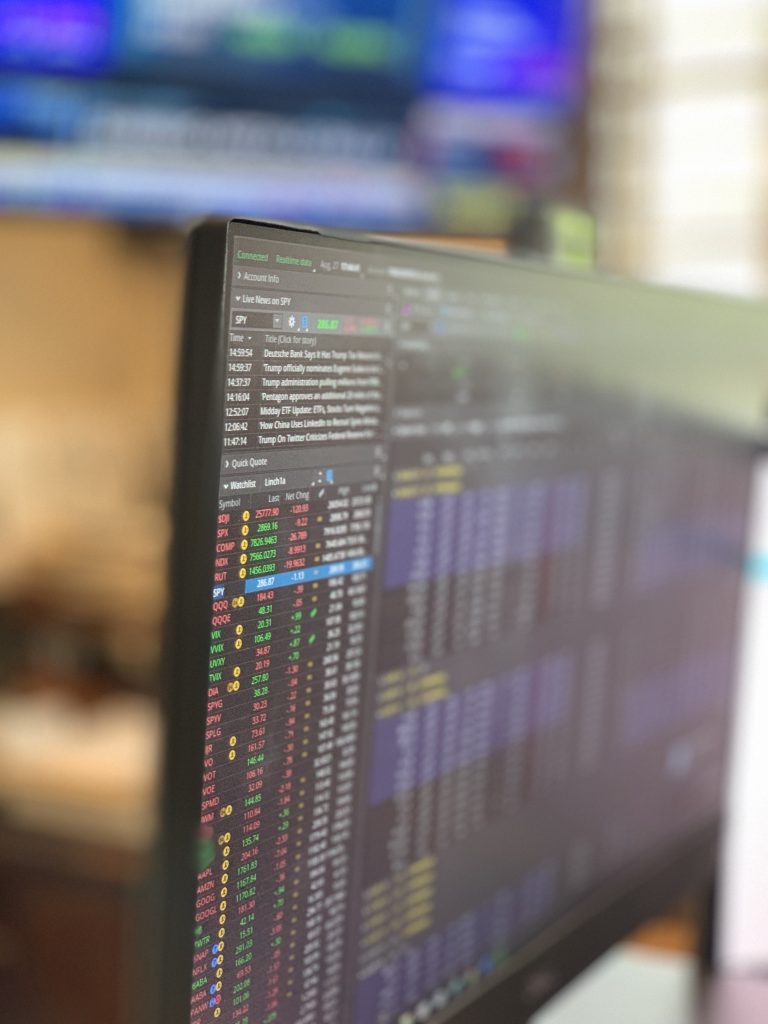

Linch Financial stands steadfast on the premise that effective wealth management is built on a disciplined investment process and integrated expertise in investment advisory services, research, and asset management. The melding of these fundamental disciplines is a core part of Linch Financial’s distinct process and presents important advantages for clients in clarifying goals and objectives as well as identifying appropriate investment strategies to reach those goals.

For many clients, their primary goal being ‘preservation of capital’, the firm’s investment process is designed to develop strategies that have the potential to yield the highest after-tax returns with the lowest corresponding risk. For those seeking a higher level of asset growth, Linch Financial employs extensive market and technical acumen to select appropriate investments.

Linch Financial’s three-pronged process integrates expertise in investment management services, research, and asset management and includes:

- Identifying Objectives

- Constructing The Investment Strategy

- Evaluating Performance Against Objectives